CoreCard Software: A Comprehensive Guide to Features, Benefits, and Industry Impact

One major company in the fintech space is CoreCard Software, which specialises in offering cutting-edge software solutions for processing credit, debit, and prepaid cards. Given how quickly the financial services industry is changing, CoreCard has made a name for itself as a vital resource for banks, merchants, and others trying to simplify their card processing operations. This post explores the main attributes, advantages, and overall effects of CoreCard Software, with a particular emphasis on ranking keywords that are crucial for search engine optimisation (SEO).

Leading software supplier

CoreCard helps financial institutions all around the world simplify and

maximise their card issuing and payment processing processes (Payment

processing software). It helps banks, credit unions, and other financial

organisations to provide their clients with smooth payment experiences by

emphasising efficiency and innovation.

Important CoreCard Software Features:

1. Card

Management and Issuance:

Modern financial services would

not be possible without the issuing and management of cards, which allow

institutions to provide a variety of card products, such as credit, debit, and

prepaid cards. This procedure entails creating and distributing cards,

maintaining cardholder accounts, and supervising a card's whole lifecycle—from

activation to cancellation.

This procedure is made easier by sophisticated platforms like CoreCard Software (Card issuance software), which automate important operations including card creation, personalisation, and delivery. Additionally, real-time account changes are supported by the software, which improves customer satisfaction by enabling prompt card issue and activation. Institutions can also control card limits, keep an eye on transactions, and tailor card programs to suit particular client needs.

Sustaining security, guaranteeing

adherence to industry norms, and offering a smooth experience for the issuer

and the cardholder all depend on efficient card issuance and administration

systems. The effectiveness and profitability of financial institutions'

operations depend heavily on these systems.

2. Real-time

Transaction Processing:

Modern financial systems must have real-time transaction processing, which enables transactions to be handled promptly as they happen. This feature guarantees prompt payments, transfers, and purchases, which is essential for improving the client experience.

Financial organisations can

approve or reject transactions in milliseconds thanks to real-time processing

platforms like CoreCard Software. The danger of fraud is decreased by this

prompt response since suspicious activity can be quickly detected and dealt

with. Furthermore, real-time processing facilitates smooth account

administration by enabling the real-time updating of balances and transaction

history, giving cardholders accurate and current information.

Beyond just increasing client

happiness, real-time transaction processing has further advantages. By lowering

manual intervention, minimising errors, and guaranteeing compliance with

financial requirements, it also improves operational efficiency for businesses.

Therefore, real-time processing is an essential component of any organisation

that wants to offer premium financial services.

3. Fraud

Detection and Prevention:

Financial security's essential elements of fraud detection and prevention are meant to shield clients and companies against deceptive practices. Financial institutions depend on cutting-edge technology, like those offered by CoreCard Software (Fraud prevention software), to protect transactions and account information due to the growing sophistication of fraud strategies.

The fraud detection solutions

offered by CoreCard analyse transactions for odd patterns or behaviours using

machine learning algorithms and real-time data analysis. The technology can

automatically flag or prevent transactions when it notices questionable

activity, lowering the possibility of fraudulent charges or unauthorised

access. This preemptive strategy lessens the effect on actual customers while

also preventing possible losses.

Additionally, the software is

always evolving to meet new threats, guaranteeing that the tactics for

preventing fraud continue to work against novel forms of fraud. Financial

institutions may preserve security and confidence while safeguarding their

assets and client information by incorporating fraud detection and prevention

into the transaction process.

4. Compliance

and Adherence to Regulations:

For financial institutions to operate within legal frameworks and uphold the greatest levels of security and transparency, compliance and regulatory adherence are crucial. Respecting industry-specific norms and laws such as PCI DSS (Payment Card Industry Data Security Standard) is essential to safeguarding private client data and averting fines.

CoreCard Software (Financial

technology ) is made to make it easy for institutions to comply with these

regulations. The platform automatically enforces rules and standards for all

transactions and card management activities by integrating compliance checks

into its core processes. Data encryption, safe access restrictions, and

frequent auditing tools that guarantee continuous compliance are all part of

this.

CoreCard (FinTech) lowers the

risk of non-compliance, which can result in expensive fines and reputational

harm, by incorporating compliance into routine business activities.

Additionally, the software is updated frequently to conform to changing

requirements, guaranteeing that financial institutions maintain compliance in a

constantly shifting legal environment and building client trust and security.

5. Integration

& Customisation:

Key components of contemporary financial software are integration and customisation, which enable organisations to easily integrate their systems with pre-existing platforms and modify their systems to suit particular requirements. These are the areas where CoreCard Software shines because of its broad integration possibilities with many systems, including ERP, CRM, and other financial tools. By ensuring a seamless data flow between departments, this improves operational effectiveness and lessens the need for human data entry.

Equally crucial is customisation,

which enables companies to modify the program to meet their own needs. Institutions

can utilise CoreCard to customise user interfaces, change workflows, and create

reports that match their own branding and procedures. Because of this

versatility, businesses may tailor their card processing and administration

systems to meet the needs of their customers and their own business models.

With CoreCard's extensive

integration and customisation options, financial institutions may create a

system that is both effective and specifically tailored to their operational

objectives.

6. Reporting

and Analytics:

In financial management, reporting and analytics are essential tools that help organisations understand their operations, clientele, and overall performance. Comprehensive reporting and analytics tools from CoreCard Software let companies keep an eye on important data including transaction volume, fraud trends, and card usage patterns. These resources are necessary for maximising financial strategies and making well-informed judgements.

The reporting system from

CoreCard provides customised reports that can be made to match particular business

requirements. Users are able to track key performance indicators (KPIs),

provide thorough reports of financial activity, and spot trends over time. By

offering sophisticated data visualisation and predictive analytics, the

analytics component goes above and beyond in assisting organisations in

projecting future trends and identifying possible hazards.

With these features, CoreCard

provides proactive card program management for organisations in addition to

assisting them in upholding accountability and transparency. greater

decision-making, greater customer service, and higher financial performance are

the results of this.

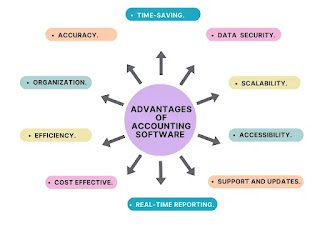

Advantages of Using CoreCard Software:

·

Increased Productivity and Efficiency:

CoreCard Software minimises errors, expedites processing, and lowers manual

labour by automating card management procedures. Improved service delivery and

cost savings are the results of this efficiency.

· Better Customer Experience: CoreCard's real-time processing capabilities guarantee that users of their cards have a flawless experience. Among the ways the program improves user happiness are prompt transaction approvals, precise billing, and attentive customer support (Customer relationship management (CRM) for financial institutions).

·

Scalability: CoreCard (Scalable

payment solutions) is designed to grow alongside companies of any size, from

start-ups to major multinational corporations. Without sacrificing performance,

the software can manage growing transaction volumes and facilitate the

expansion of card programs.

·

Risk Mitigation: Businesses can

reduce financial losses resulting from fraudulent activity by utilising

CoreCard's sophisticated fraud detection and prevention systems. Rapid

responses to potential dangers are made possible by the software's real-time

monitoring and notifications.

·

Regulatory Compliance: Financial

institutions place a high premium on adhering to industry regulations. By

ensuring that companies follow all applicable laws, CoreCard lowers the

possibility of legal problems and penalties.

Drawbacks of Corecard Software that companies ought

to take into account:

Ø

Complexity of Implementation:

Smaller companies without substantial IT resources may find CoreCard

implementation to be particularly challenging. Longer implementation timeframes

and higher initial costs may result from the software's extensive functionality

and customisation choices, which may require a great deal of effort and skill

to configure correctly.

Ø Cost: For startups or smaller businesses, CoreCard Software may be prohibitively pricey. For companies with tight budgets, it may be more expensive to use because of the license, customisation, and continuous maintenance expenses.

Ø

Integration Difficulties: While

CoreCard has rich integration features, integrating it with legacy systems

already in place might be difficult. There could be incompatibilities that need

to be fixed, which would take more time and money and could cause business

activities to be disrupted during the shift.

Ø

Learning Curve: Users who are

not experienced with sophisticated financial software may find CoreCard

Software to have a steep learning curve because of its extensive feature set.

Users might need more time and training as a result before they can fully

utilise the system's possibilities.

Ø

Dependency on Vendor Support:

Due to the degree of customisation and complexity required, organisations may

find that they rely a lot on CoreCard's vendor support for upgrades and

troubleshooting. The effectiveness and dependability of the product could be

impacted by any delays or problems with vendor support.

Ø

Scalability Issues: Despite CoreCard's scalability, some firms may have difficulties as they expand, especially if their requirements change in ways that the software's architecture finds difficult to adapt to. This can necessitate switching to a different platform or perhaps further bespoke work.

Ø

Regulatory Changes: Software

must be updated frequently to remain comply with the changing financial

regulations. Even while CoreCard is built to handle compliance, the rate at

which regulations are changing may still provide problems, particularly if

updates are delayed or necessitate a major reconfiguration.

These possible downsides

emphasise how crucial it is to carefully assess CoreCard Software in light of

unique business requirements and available resources before deciding to deploy

it.

Impact of CoreCard Software on Industry

The financial services sector has benefited greatly from CoreCard Software's dependable, scalable, and secure card processing technology. By utilising CoreCard, financial institutions can provide cutting-edge card services and products, increasing their marketability.

Furthermore, CoreCard has

established itself as a pioneer in the financial industry thanks to its

dedication to innovation and constant improvement. The company stays at the forefront

of the market because of its focus on incorporating cutting-edge technology

like machine learning (ML) and artificial intelligence (AI) into its platform.

CoreCard Software in a Market With Competition

CoreCard Software distinguishes

out in a highly competitive market because of its extensive feature set,

scalability, and dedication to customer success. Similar services are provided

by other market participants like Fiserv, TSYS, and FIS, however CoreCard has

an advantage due to its emphasis on customisation and real-time processing.

Who Can Use CoreCard:

Financial Institutions are the target audience for

CoreCard:

Ø

Banks: CoreCard is perfect for banks that

provide services related to credit, debit, and prepaid cards. It supports the

management of card issuance, transaction processing, fraud protection, and

regulatory standard compliance.

Ø

Credit unions: By taking use of CoreCard's

scalability and customisation capabilities, credit unions can utilise it to

provide card services to its members.

Ø Fintech Businesses: By utilising CoreCard, fledgling and well-established fintech companies can create cutting-edge financial solutions including digital wallets, payment applications, and other card-related services.

Merchants & Retailers:

Ø

CoreCard can be used to administer store-branded

credit and debit card systems for major retailers and merchants. It facilitates

real-time transaction processing, loyalty programs, and card issuing.

Processors of payments:

Ø

Payment processing firms may manage a variety of

card kinds' transactions with CoreCard, guaranteeing their customers safe and

effective payment processing.

Business Organisations:

Ø

Companies can use CoreCard to manage corporate

cards, track spending, and enforce spending policies for employees who get them

for business costs.

Governmental Organisations:

Ø

To ensure compliance with government rules,

CoreCard can be used by government agencies that issue prepaid cards for

benefits or disbursements to manage the issuance and distribution of these

cards.

Where CoreCard Is Applicable:

Worldwide Reach:

Ø

Because CoreCard supports many currencies and complies

with numerous international laws, such as PCI DSS and GDPR in Europe, it is

intended for usage by organisations globally.

Strong Financial Regulation Regions:

Ø CoreCard works especially well in areas like North America, Europe, and some parts of Asia where financial rules are strict. For companies that operate in these sectors, its compliance features make it a dependable option.

Developing Markets:

Ø

CoreCard can be used to provide unbanked or

underbanked populations with innovative financial products, such prepaid cards

and digital wallets, in emerging nations where financial inclusion is

increasing.

Multinational Enterprises:

Ø

With CoreCard, multinational companies can

standardise card issuance and management across national borders, guaranteeing

uniformity and compliance in all business processes.

Use Case Situations:

Retail chains: Managing loyalty programs,

offering financing choices, and introducing store-branded credit cards in

various locations.

Banks: Providing a broad range of card services, including digital payments and traditional credit cards, while guaranteeing adherence to national and international laws.

Fintech Startups: Introducing new financial

products that need strong card processing capabilities, such as peer-to-peer

payment systems or mobile wallets.

In conclusion, CoreCard Software

is an adaptable and scalable solution that a range of businesses in various

locations may utilise to effectively manage card-related services.

In summary

For financial organisations

looking to simplify their card issuing and payment processing, CoreCard

software provides a comprehensive solution. With its extensive feature set,

emphasis on preventing fraud, and dedication to regulatory compliance, CoreCard

helps banks, credit unions, and other financial institutions to provide their

clients with outstanding payment experiences.

You may efficiently optimise your

blog posts and articles for search engines, boosting their visibility and

drawing in more readers, by including the pertinent ranking keywords into your

content. You may establish yourself as a reliable authority in the field of

CoreCard software and payment processing solutions by heeding the advice and

techniques provided in this article.

For financial institutions and

companies wishing to update their card processing systems, CoreCard Software is

a vital tool. CoreCard has established itself as a dependable partner in the

financial sector thanks to its strong feature set, scalability, and emphasis on

compliance. CoreCard provides the resources you need to securely and

effectively manage your card programs, regardless of the size of your company.